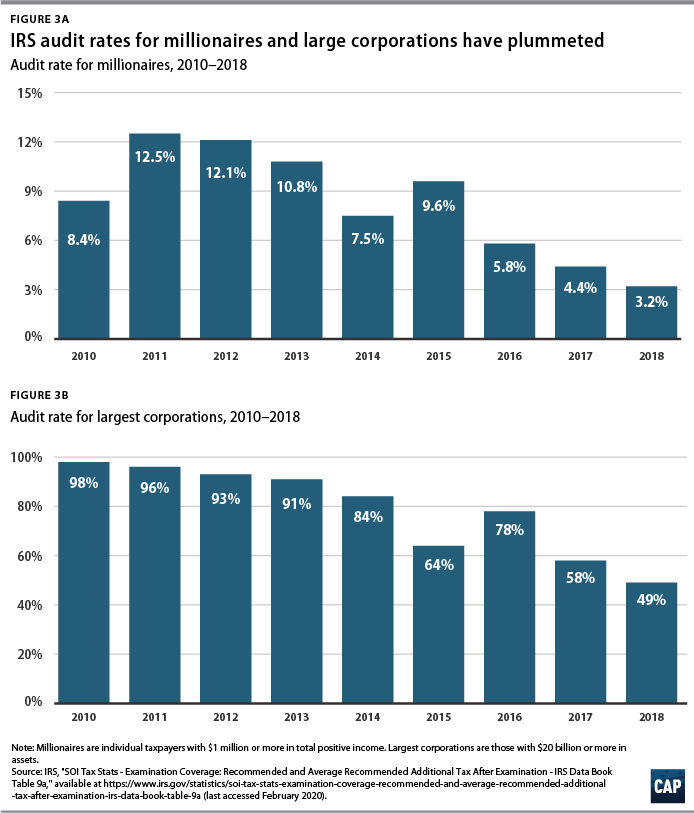

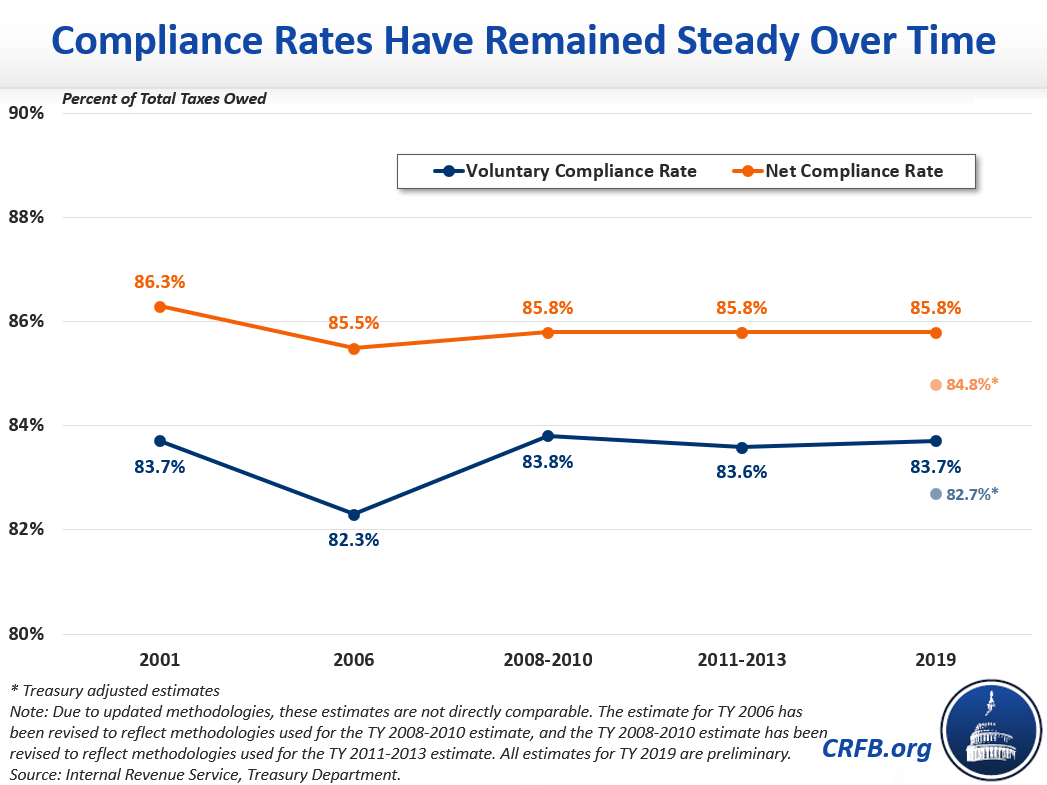

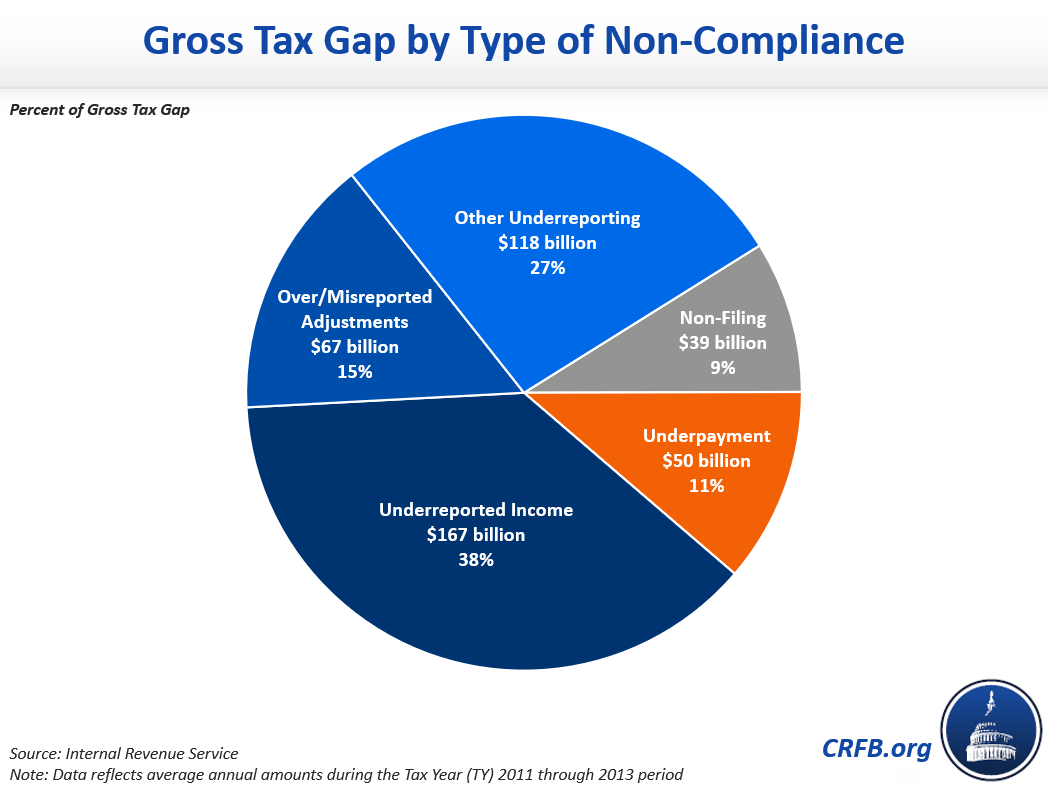

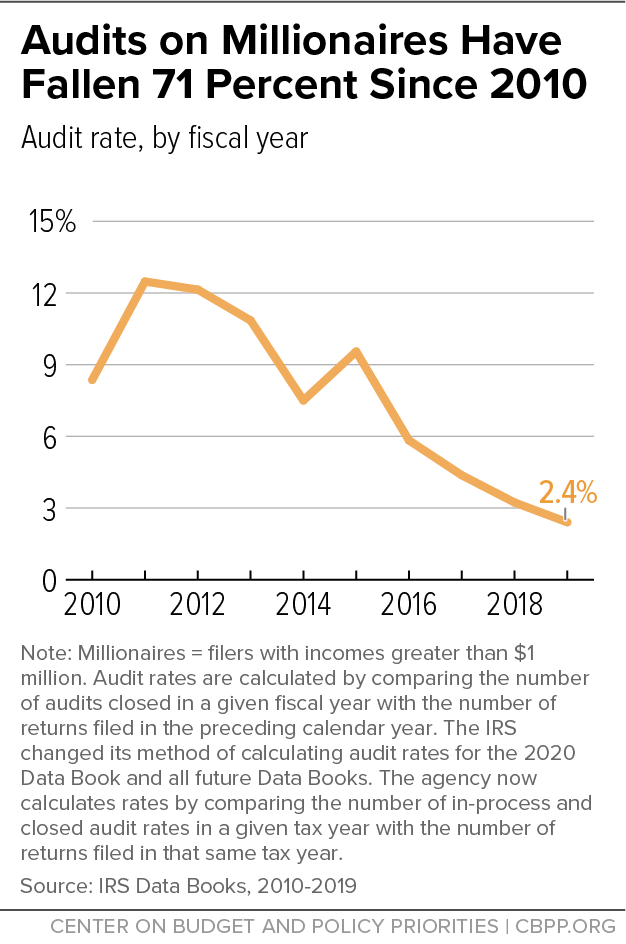

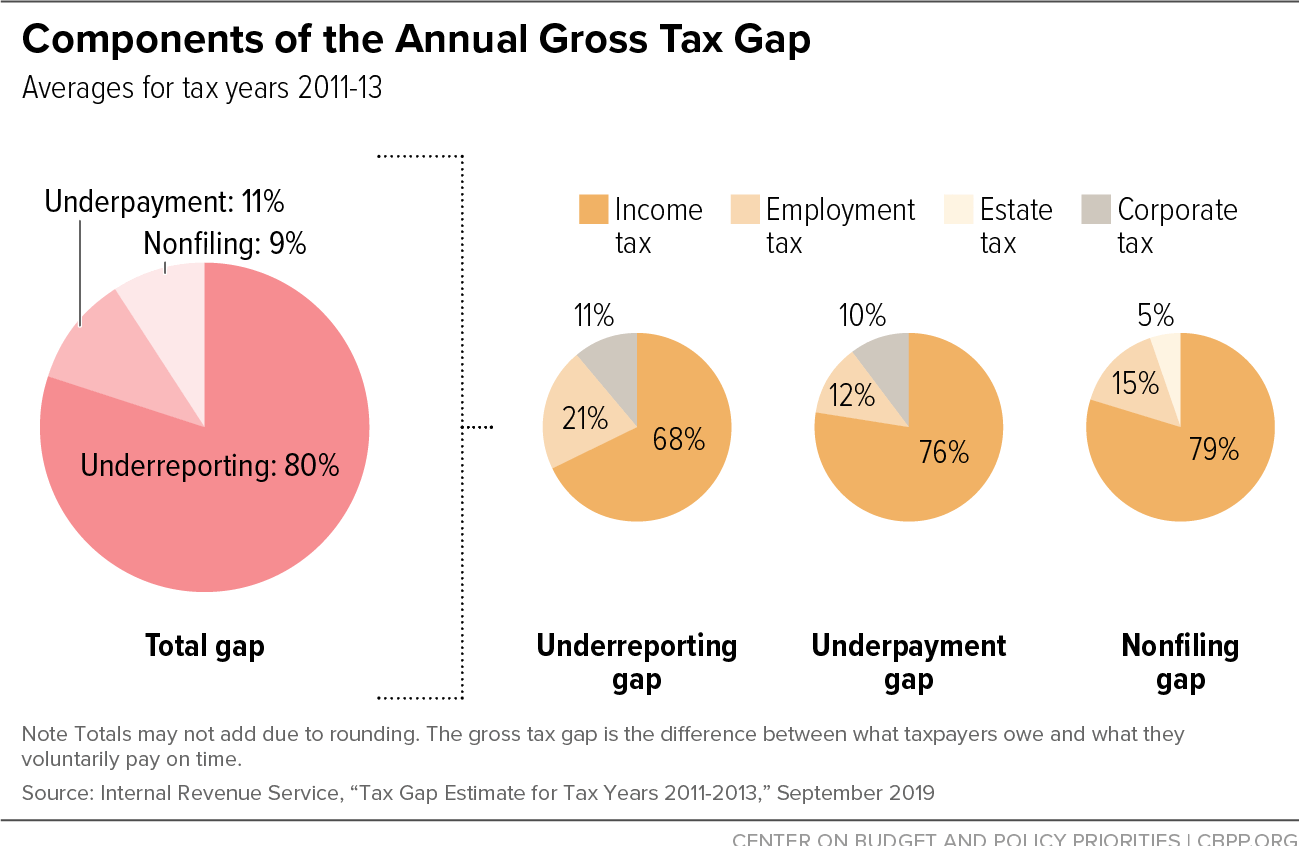

Rebuilding IRS Would Reduce Tax Gap, Help Replenish Depleted Revenue Base | Center on Budget and Policy Priorities

Rebuilding IRS Would Reduce Tax Gap, Help Replenish Depleted Revenue Base | Center on Budget and Policy Priorities

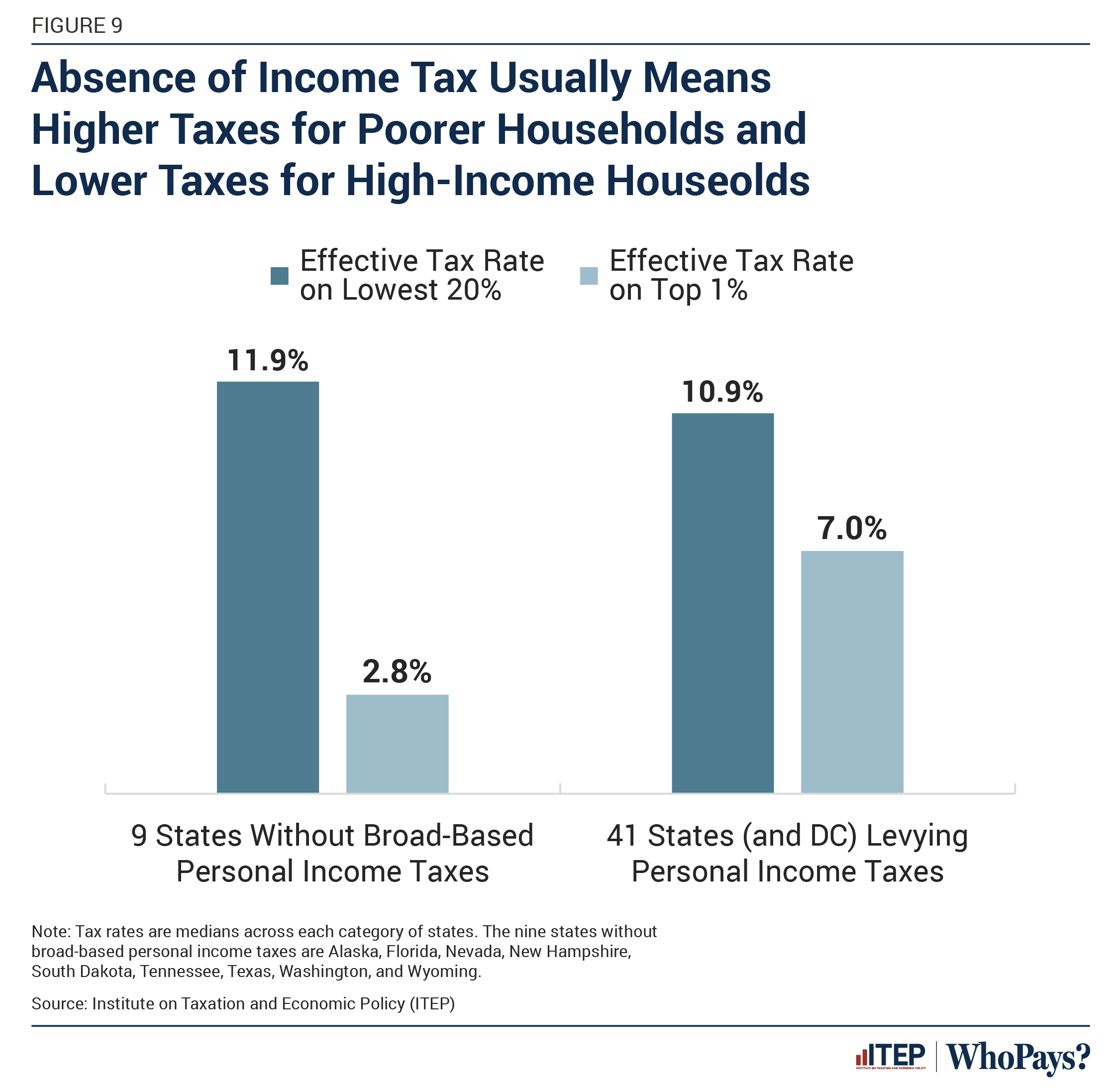

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes – ITEP